Share this post

Never mind the shipping crisis, I can’t get my goods to the port!

The global shipping crisis has stolen the spotlight and our attention for months now. Quite rightly too, as we’ve had, and have, much to report on (The current state of the industry, Global container imbalance, Suez Canal blockage, Yantian port crisis). But it suddenly dawned on me that whilst we’re all focused on the sea leg of a cargo’s journey, what’s happening at the beginning and the end of it. Unprecedented levels of congestion at port and Covid related restrictions slowing operations, coupled with record levels of demands for containers must be causing serious chaos in-land. And it is.

Here’s what Beth Salvato, Hillebrand’s Procurement Supervisor (Edison, New Jersey) USA told me about their inland trucking situation.

Capacity

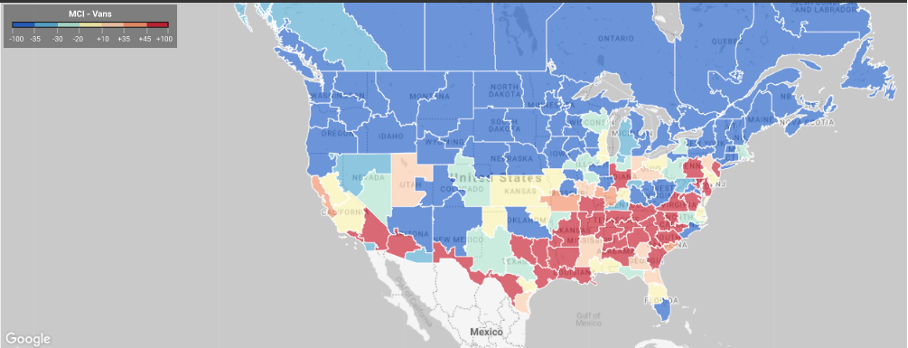

Take a look at the image below. A scary snapshot of the current state of dry truck availability across the US right now. It’s a measurement of container loads which are available for pick up to the number of trucks available to haul them. The darker the red the lower the capacity. As you can see, the main challenges are in New York, south eastern USA and northern and southern California; highly trafficked freight spots, especially in the wine industry. For context, this sector has seen a 220% YoY increase in demand to available capacity.

It’s not better news looking at reefer truck capacity either. We’re seeing a 325% increase in demand YoY in this equipment segment. Much of this demand is driven by produce shipping in the US, specifically out of the Southeast, Texas and parts of California.

It’s a scramble every day to find available trucks and drivers to move containers. Truckers are loyal to long term customers, quite rightly, moving their cargo with priority. Outside of this, there has always been capacity to buy on a spot basis, when some of their fleet is between jobs and sitting idle. This is not the case now. There are no holidays or moments for truck washing. Demand is exceeding capacity like we’ve never seen. So shippers, NVOCCs and carriers look to even the smallest of truckers, anyone with space, and at any cost too.

Rates

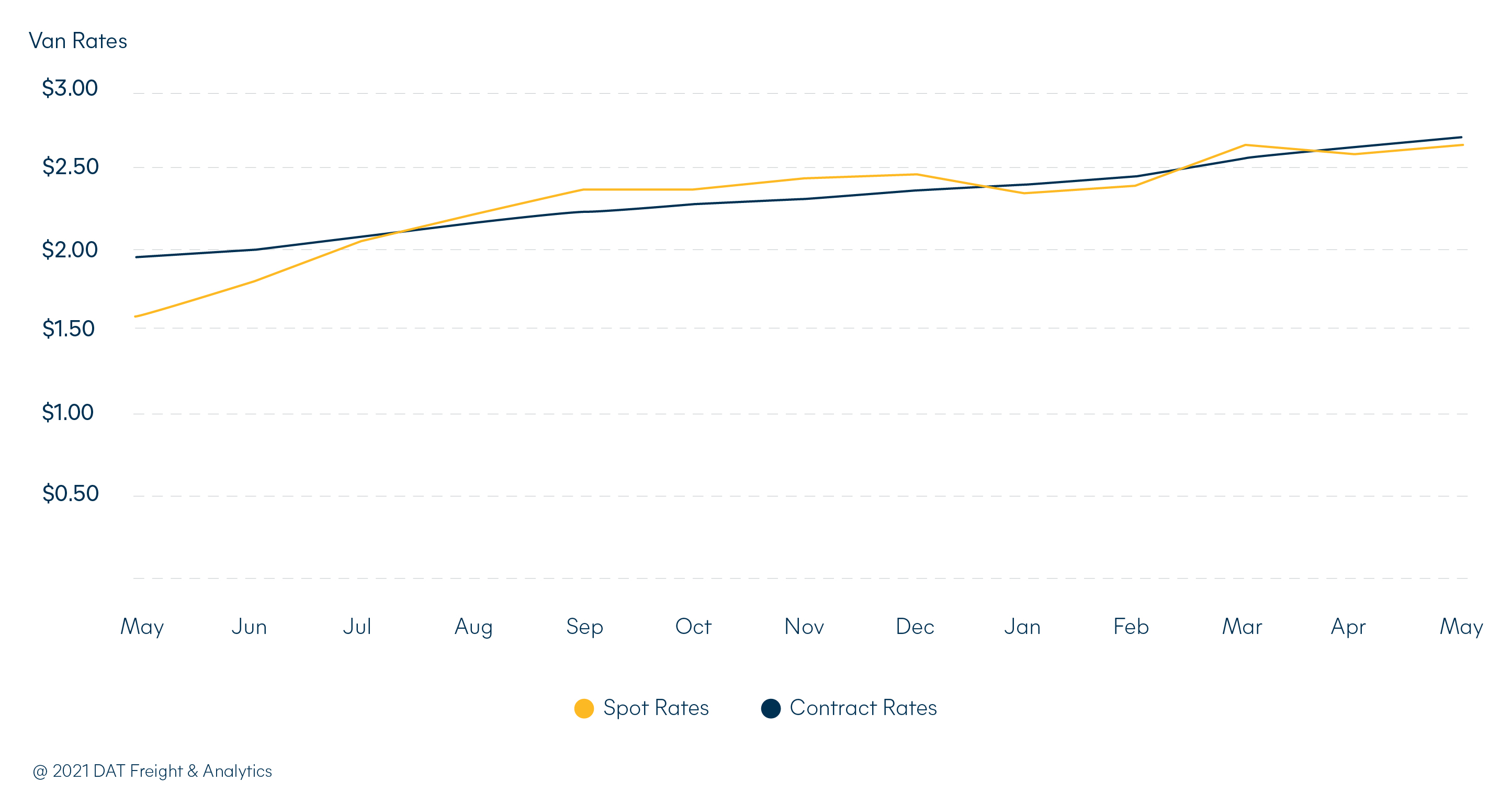

Here’s another very real statistic that will have you shouting ‘no way!’, dry inland hauls (non-drayage) show a 67% YoY cost increase. To spell this out in actual cash terms that is a jump from $1.60 per mile to $2.67 per mile. You can attribute that to both contract and spot freight rates. Inland reefer equipment rates are also up at 53% YoY.

It’s a trucker’s market right now. With demand so high and companies so desperate to move goods, they can name their price and it’ll get paid. If not by the person on that phone call, but by the next one.

Drivers

Average local drayage driver pay has fallen about 20% according to JOC.com. There’s also a huge problem in that there is a big shortage of trained drivers out there. On this, moving containers of package goods is one thing, but for the transport of bulk liquids, like those in flexitanks, the level of qualification and training kicks up a notch.

It’s a crazy logistics world out there but rest assured we have our ears to the ground on every continent and in every country we operate in. We’re here to support your business.

.png?sfvrsn=c3460e9d_1)